Preserving Wealth in a High Inflationary Environment

High inflation is here!

It’s not me saying. Recently, a surprising number of influential people are saying this. Ray Dalio, Michael Burry and Jim Richards have been saying this since months. I was following the inflation discussion closely, but I was doubtful.

Buffet generally stays away from commenting on such things, but in the latest Berkshire Annual Meeting even he raised concerns of high inflation. He talked about how he has seen high inflation in the business that he is involved with.

Why is inflation high?#

Due to coronavirus pandemic, governments around the world have print a whole bunch of money and injected it in the economy. Now, people have more money, but there is no change in number of service or quality of product or how individual business perform. So, because they have more money they would be willing to pay extra for the same product.

High inflation is why stock markets in US and India have seen such a massive high. Fundamentals of individual businesses are still the same as they were a year or two ago.

How to preserve or grow wealth during high inflation?#

Which businesses(stocks) to invest in?#

According to Buffet businesses with following characteristics will do well

- Businesses that require less capital investment to facilitate inflationary growth

- Businesses that has ability to increase prices rather easily without fear of significant loss of either market share or unit volume

Buy index funds#

During inflation prices of everything goes up and thus prices of stocks. You might not know which stocks to buy. In that case, you can just ride the wave and grow with the market with index funds.

Inflation is directly proportional to growth in index funds.

Diversify well#

Ray Dalio is known to diversify well. So, we can look at his portfolio, take inspiration and translate that to the Indian Market equivalent.

| Invest in | Percentage |

|---|---|

| S&P 500 | 11.9% |

| Vanguard Emerging Markets ETF | 5.7% |

| Gold (Through various gold trusts) | 7% |

| Walmart | 3.8% |

| P&G | 3.2% |

| Alibaba | 3.2% |

| IShares Emerging Markets ETF | 2.9% |

| IShares Core S&P 500 ETF | 2.6% |

| Pin Duo Duo | 2.2% |

| Coca Cola | 2.1% |

| Pepsi | 1.9% |

| Costco | 1.6% |

| McDonalds | 1.4% |

| JD.com | 1.3% |

| Startbucks | 1.1% |

| Baidu | 0.94% |

| Abbott | 0.87 |

| Remaining (Probably more ETFs and small stock positions) |

Dalio’s portfolio is wonderful. He has created a strong base through the stability of gold.

Then he has exposed himself to a whole bunch of large companies in US and Emerging Markets through Index funds and ETFs. ETFs and Index fund will give him decent returns safely. Following is my translation for Indian Market.

After such strong base, he has created roof with individual stocks. If you look at those individual stocks, most of them provide essential services, have strong business models and are leaders in their respective markets.

Most of his stock picks would satisfy two characteristics described by Buffett above

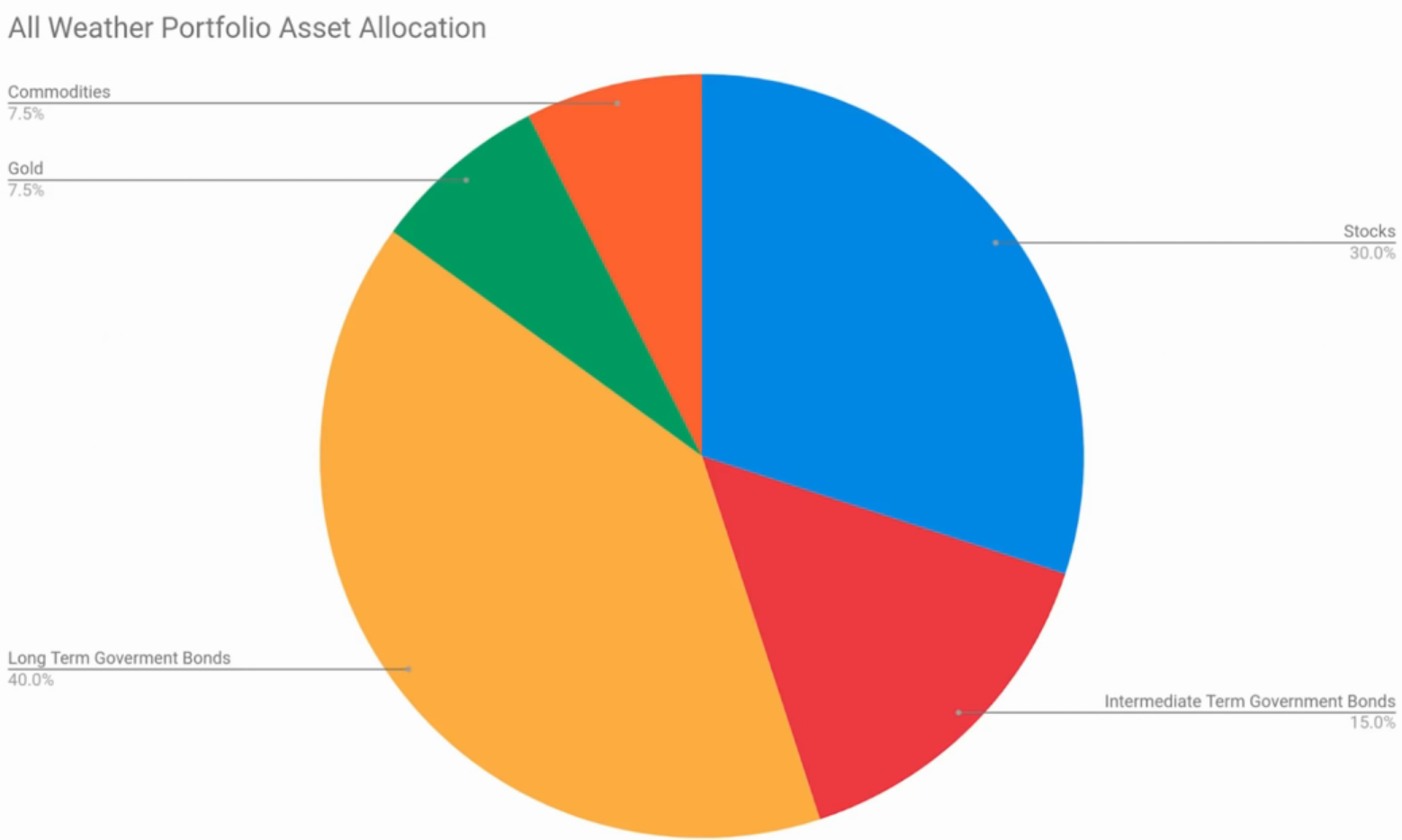

Dalio has recommended an all weather portfolio.

Personally, I don’t like high allocation to bonds in his all weather portfolio. You can take inspiration from this portfolio and make an informed judgement for your case.

Buy Gold, not Bitcoin#

Gold is a storage of wealth. With inflation gold price will also increase.

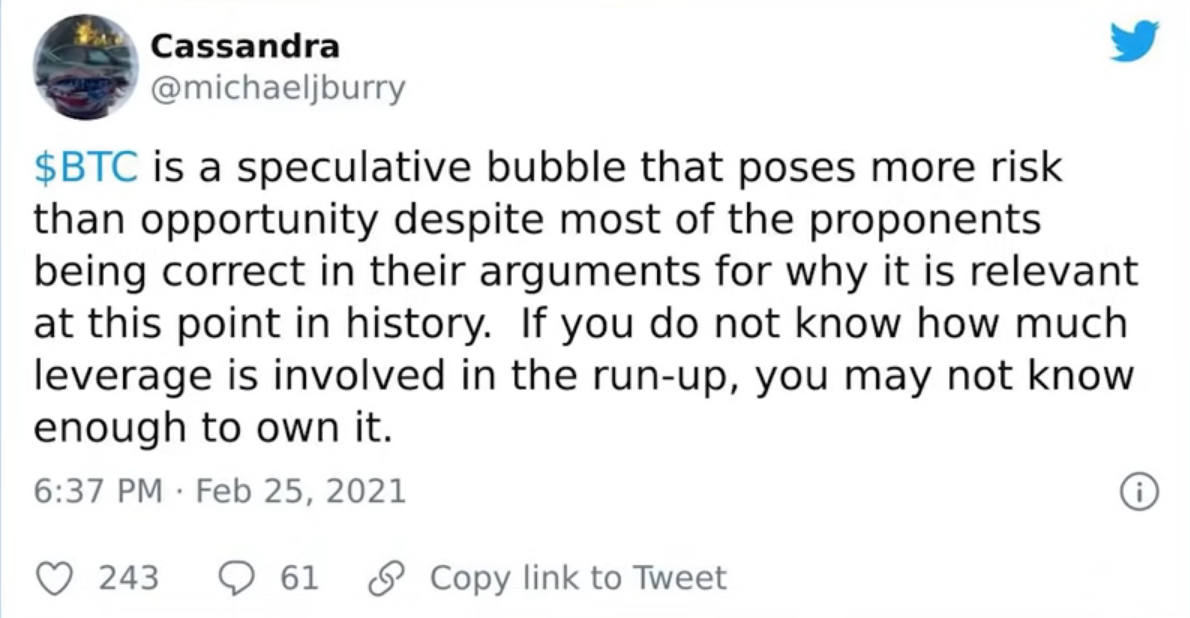

I would not recommend bitcoin. I have background in cryptocurrency and I think bitcoin is great and it can replace gold, but it hasn’t replaced just yet. On the other hand, gold has history that goes back to thousands of years as a storage of wealth.

At the moment, bitcoin is highly speculative and poses a lot of risk in terms of its value. It is nowhere near a stable storage of wealth like gold.

You can buy Gold in form of Sovereign Gold Bond, ETFs, Mutual Fund, Digital, Physical Gold. Each of these has its own risks.

My preference is to buy KOTAKGOLD ETF.

This one is a great video for deciding on which instrument to buy.

Avoid earning fix-interest on cash#

Avoid fixed deposits, bonds, debt mutual funds, etc. Buying bonds is basically loaning money to someone at fix interest.

In all of these cases, interest you earn would be far lower than inflation during that time. Thus, you will end up losing money.

Have as little cash as possible#

Inflation is basically the purchasing power you are losing for cash.

Invest in yourself#

If you have skills that are in demand in the job market, you will always make a decent living despite inflation, since you would have a steady stream of cash in-flow.

NOTE: I am in the process of learning. I update my portfolio based on my new learnings. I can’t be made responsible for you investment decision. I write these things with my current understanding. Take this with a pinch of salt and verify what does or does not make sense for you, before investing.